tax credit community meaning

Tax credit can be defined as a reduction in the total tax amount someone owes to the Internal Revenue Service IRS. Community Tax Credit Empowered Giving Community Tuition Grant Organization To provide low-income families with tuition assistance and to offset the cost of tuition for parents who.

Senate Moves Forward With Ev Tax Credit Reform Tesla Tsla To Be Included Back And More Electrek

What Is A Tax Credit Community.

%20(1)-page-002.jpg?width=720&watermark=&hash=klaf2w5hY6T9FeuLAJmsCHWZ3g8v7VA2345F1F-PDzM)

. Unlike a tax deduction which reduces taxable income a. The Low-Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low- and moderate-income tenants. An income tax credit equal to 10 of the annual market rent for the specific qualifying housing unit.

A tax credit is a type of tax incentive that can reduce the amount of money a taxpayer owes the government. It can be considered a type of financial incentive provided to the. An amount that may be subtracted from the sum of tax otherwise due and that is distinguished from a deduction applied to gross income in the calculation of.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. California Competes Tax Credit Income tax credit available to businesses that want to locate in California or stay and grow in California California Employment Training Panel Funding. Tax credits reduce the amount of income tax you owe to the federal and state governments.

An amount of money calculated according to someones personal situation that reduces the amount of tax they must pay. The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal. Now tax credits can be an effective tool for promoting economic activity that engages significant private financial support and that is sensitive to community needs.

The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property. Both programs were created to promote private. Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to provide.

Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to provide. Noun C TAX uk us. Correct answer A tax credit property is an apartment complex or housing project owned by a landlord who participates in the federal low.

The California Tax Credit Allocation Committee CTCAC administers the federal and state Low-Income Housing Tax Credit Programs. Low-Income Housing Tax Credit Programs. Opportunity Zones are census tracts that are economically-distressed communities where new investments may under certain conditions be eligible for preferential.

A tax credit differs from deductions and. A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar. The tax credit will cost taxpayers 64.

Well prorate the credit for a unit that is qualified for less than a full year. The California Tax Credit Allocation Committee CTCAC facilitates the investment of private capital into the development of affordable rental. A tax credit differs from deductions and exemptions.

Legal Definition of tax credit.

Property Tax Deduction Definition

Community Opportunity Tax Credit Filed Hb 885 North Carolina Housing Coalition

Ncp Professional Development Center Elizabeth Moreland Consulting

What Is The Child Tax Credit And How Much Of It Is Refundable

Federal Solar Tax Credit 2022 How Does It Work Adt Solar

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Jessejenkins On Twitter Bikes Employers Can Offer Bike Commuting Benefits To Their Employees Worth Up To 52 50 Month And Treat These Expenses As Tax Deductible And A New Tax Credit Or 15

The 2021 Child Tax Credit Implications For Health Health Affairs

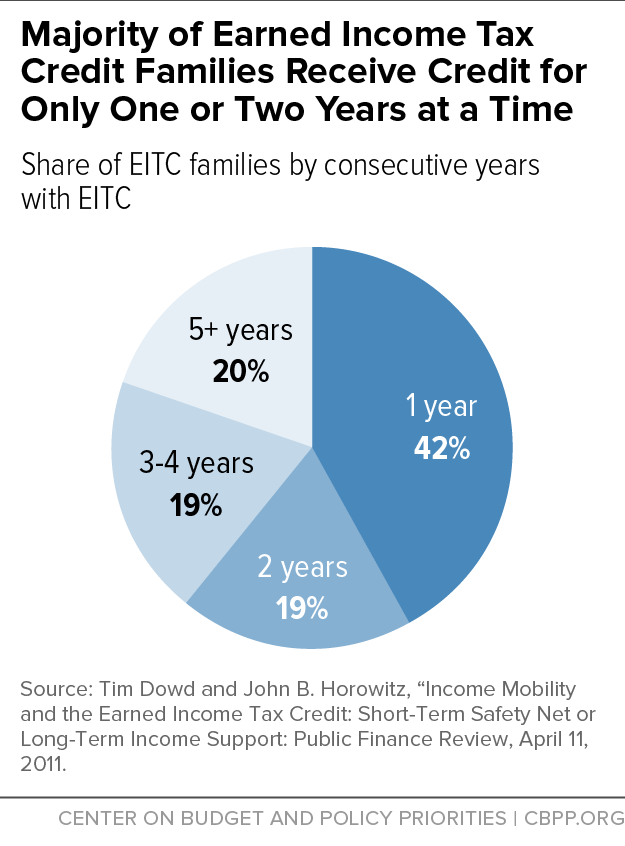

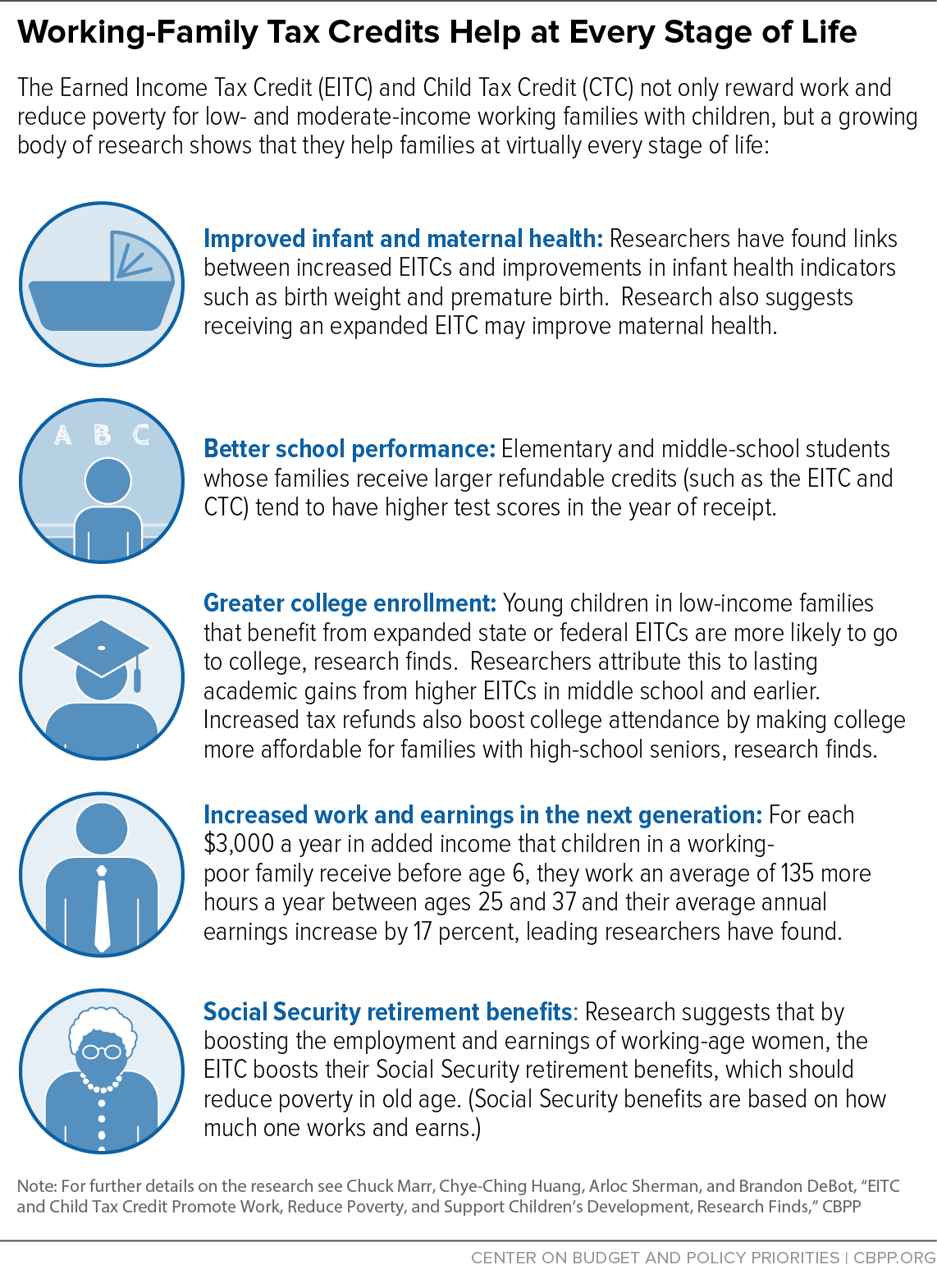

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Potential Costs And Impact Of Health Provisions In The Build Back Better Act Kff

Ihcda Rental Housing Tax Credits Rhtc

Earned Income Credit Eitc Definition Who Qualifies Nerdwallet

Proposed Us Tax Credits On Evs Taycanforum Porsche Taycan Owners News Discussions Forums

Tax Credits Vs Tax Deductions Nerdwallet

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

Mortgage Credit Certificates Texas State Affordable Housing Corporation Tsahc

What Is The Difference Between A Refundable And A Nonrefundable Credit Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/welfare-programs-definition-and-list-3305759v2final-733799332f254adf9113173d6ae6538f.jpg)